Unbelievable Info About How To Apply For Property Tax Adjustment

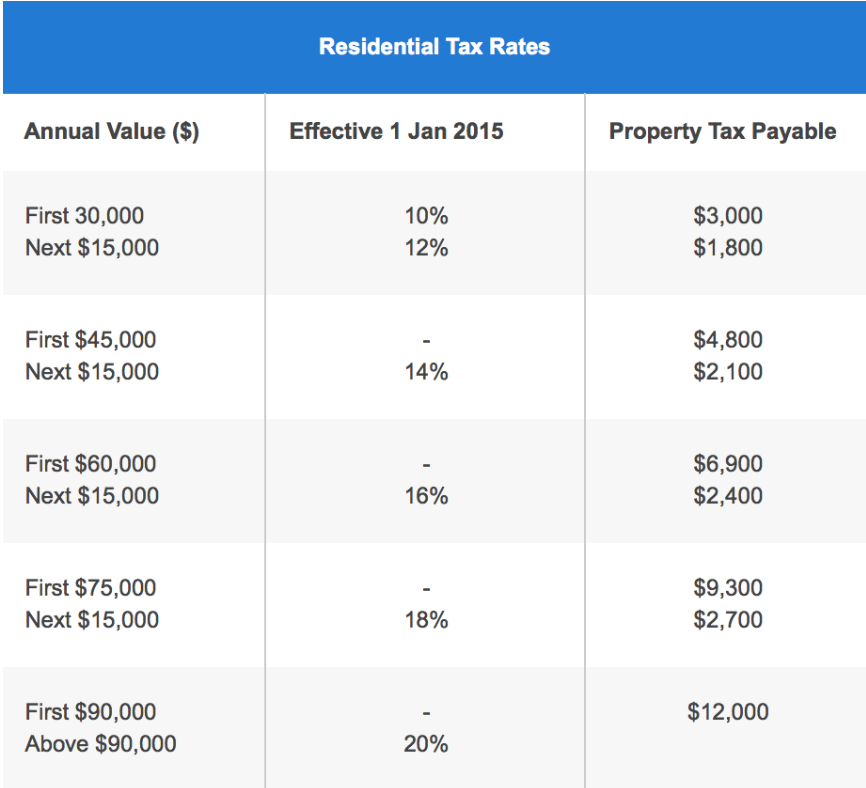

How the average agent calculates property.

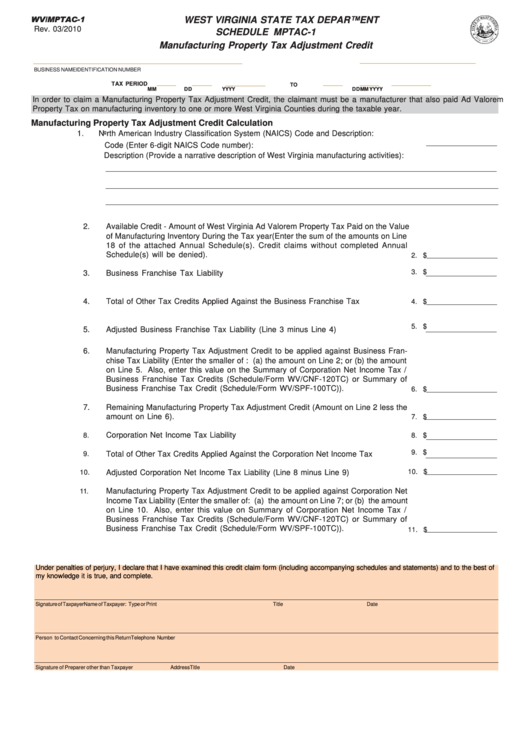

How to apply for property tax adjustment. (1) administer tax law for 36 taxes and fees, processing nearly $37.5. Any person qualifying for this deferral program would receive. When buying or selling a property, a portion of the annual property tax will be factored into the amount.

You should complete and file all required forms and applications for these exemptions with your county property appraiser. To apply for a senior property tax exemption, you’ll need to contact your local tax assessor’s office or visit their website. For property tax refunds involving multiple property owners, the refund will be processed to the owner listed first in the notice of transfer or the main applicant listed in the.

Starting in 2024, st. Proof of age (driver license, florida id, voter id, or birth certificate) if required to file a federal income tax return: Filing for a property tax adjustment with your municipality.

Property tax exemptions & deferrals. The limited income deferral program postpones payment of 50% of your taxes and/or special assessments. From 1 january 2024, the apportionment of land tax between a vendor and purchaser under a contract of sale of land will be prohibited.

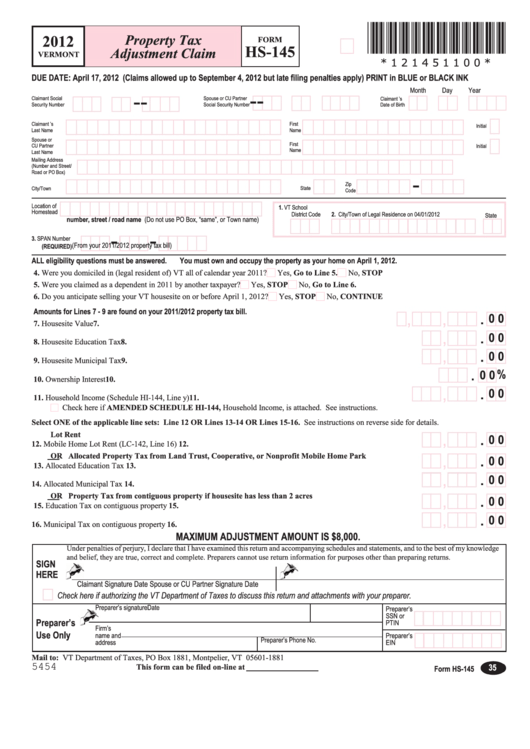

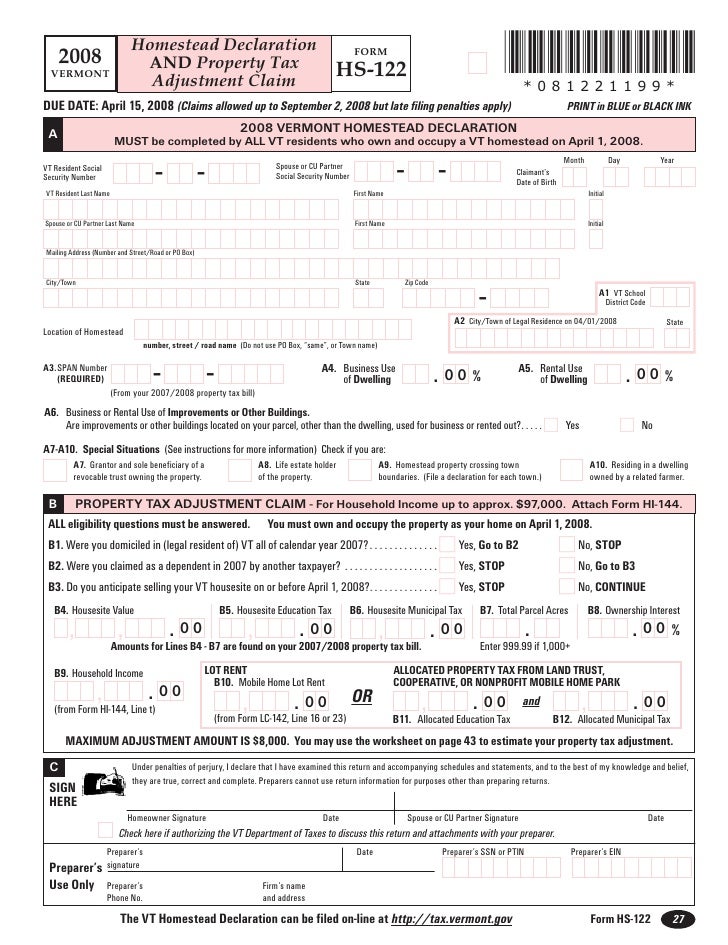

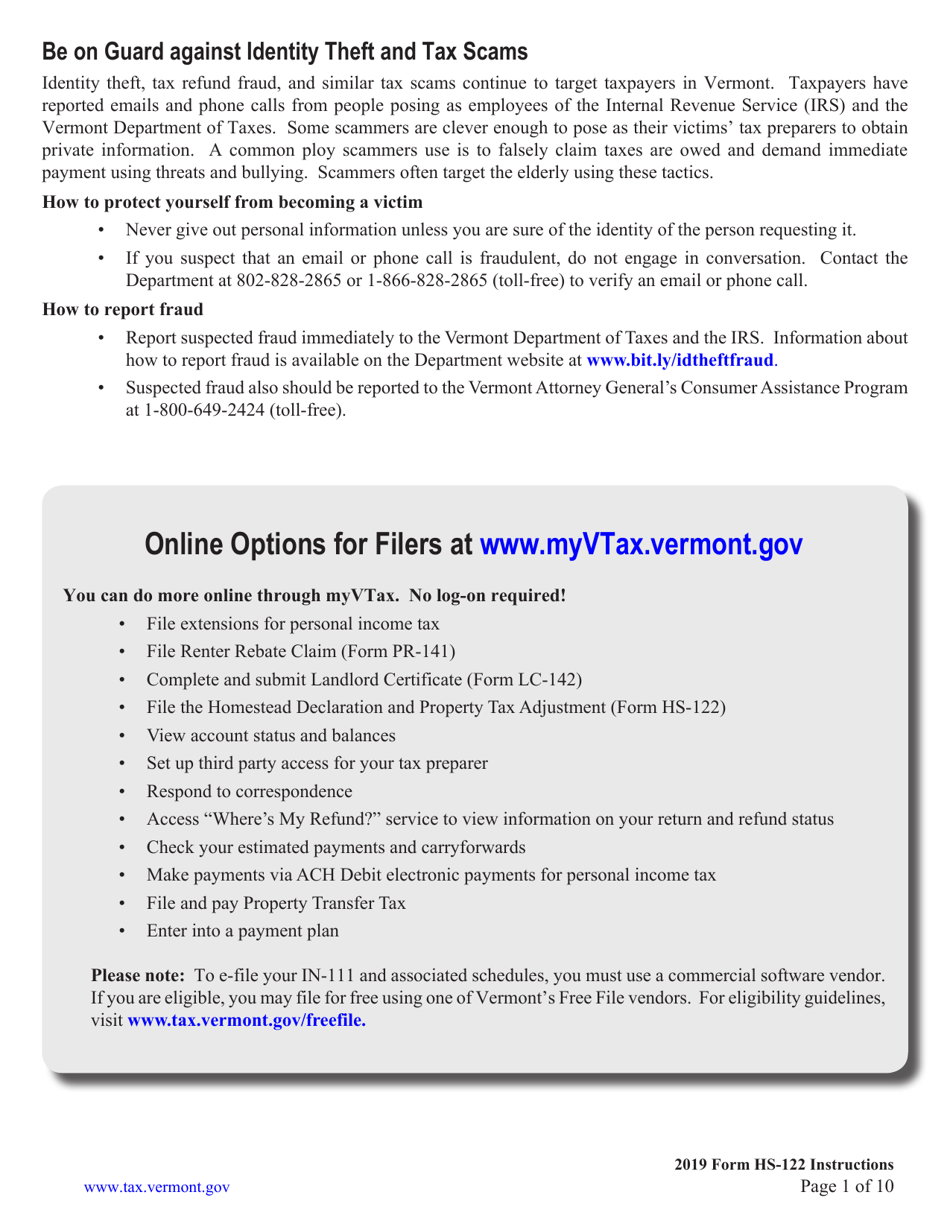

You need to file the following two forms to apply for a property tax credit. You can submit your claim electronically when you file your vermont income tax return. There is some good news for homeowners, however.

Tax adjustment applications made under section 357 of the municipal act can be submitted for the current taxation year and must be received by the city on or before the. How are property taxes adjusted when you buy a home? Access the classifications and information about the current use.

We are also going to show you how to apply your adjustments to comparable properties and make sure they are valid. The rebate is applied to your account to offset property taxes. Only municipal council has the power to determine if you are eligible for a property tax.

If the property appraiser denies your. Maryland lawmakers are looking at a legislative solution to address a missed mailing. A proposed state law passed by the ohio senate wednesday would temporarily (the next three taxing years) exempt older.

This program replaces the previous programs offered by the city and the region of peel. You can appeal your property assessment, and success means your tax bill could be lowered by hundreds to. You must follow the process set out by your municipality for applying for a property tax adjustment, and your municipality will assess your application and make the final decision.

They will provide the necessary.