Fun Info About How To Claim Property Tax In Ontario

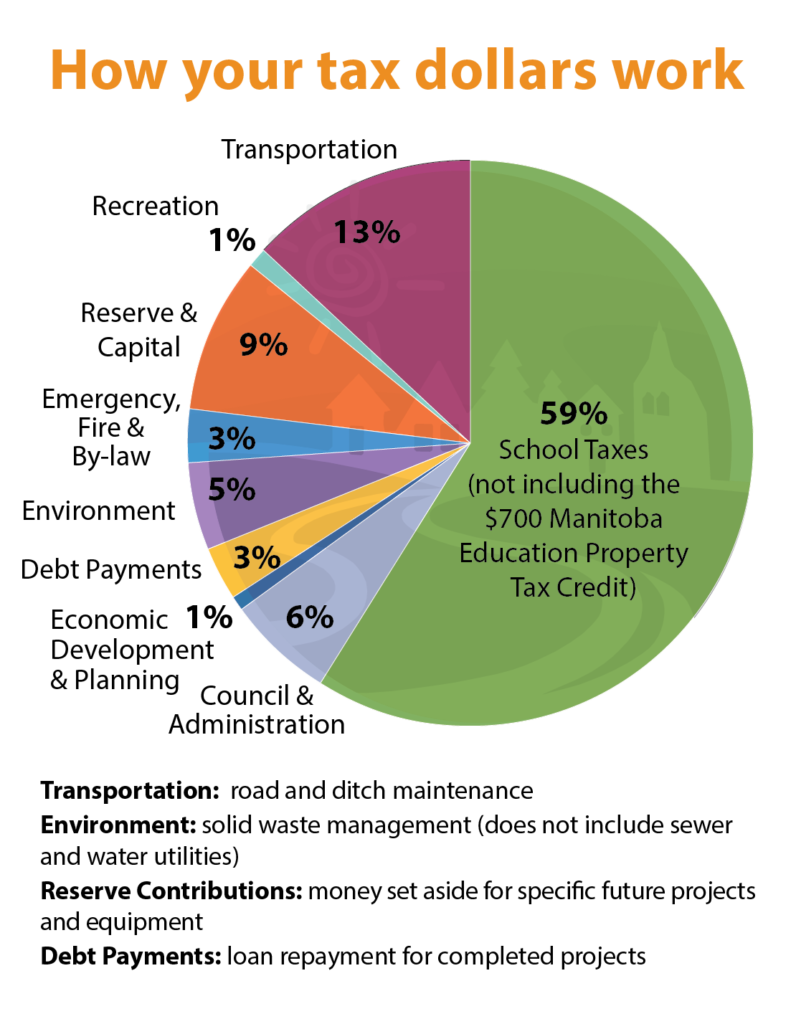

Property assessment property taxes in ontario are determined using a system known as the municipal property assessment corporation (mpac).

How to claim property tax in ontario. How to claim rent on tax return as a canadian looking to claim rent in their tax return, you have two options. You may qualify for the grant even if you do not owe income tax. The province contributes the rest.

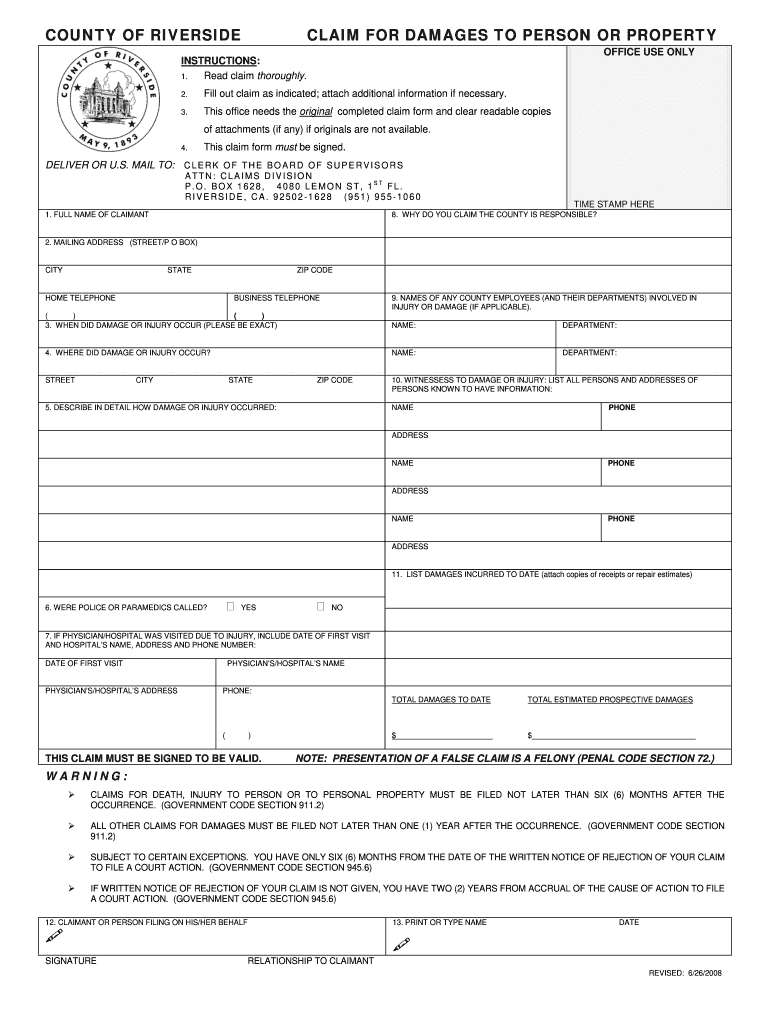

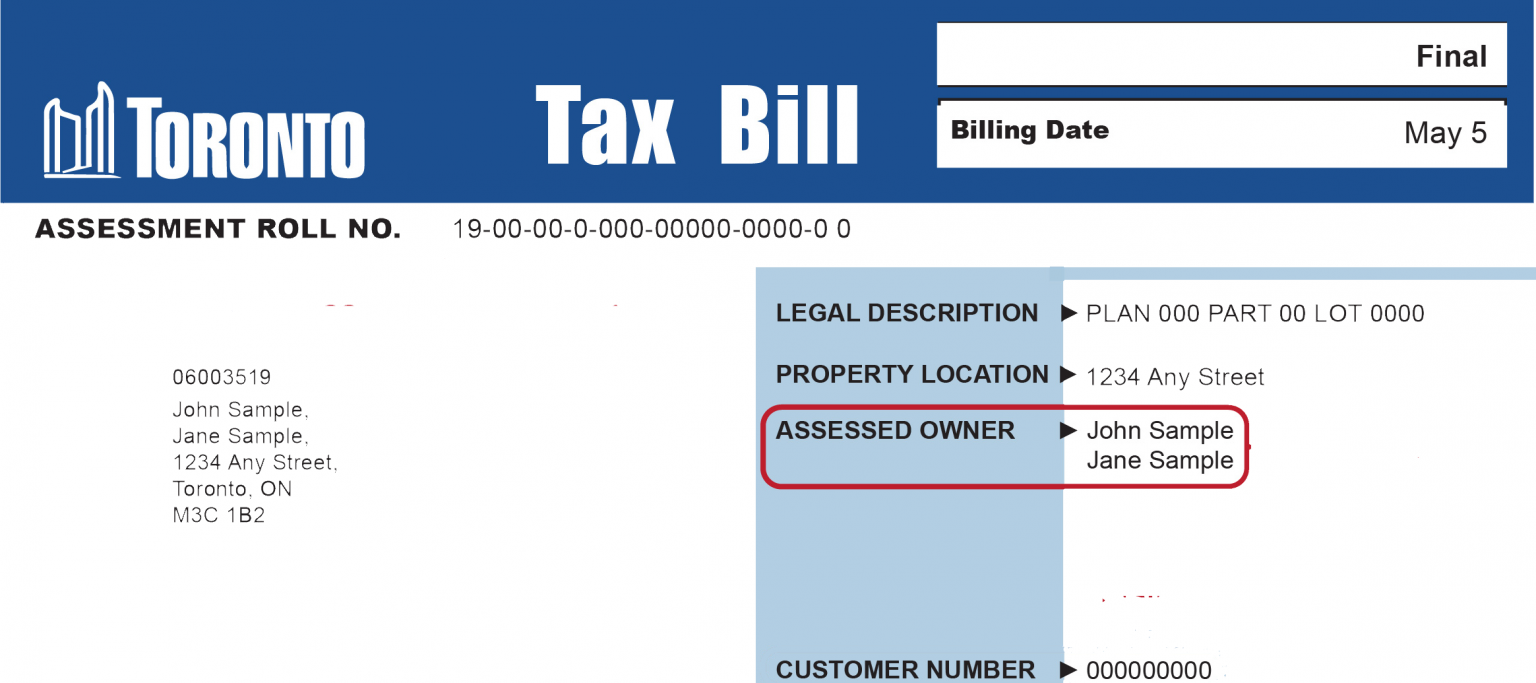

Qualify for a tax credit related to eligible rent payments in one of three provinces:. Every year, your municipality will mail you a tax bill for every property you own. Owners of residential properties in toronto have until thursday, february 29, 2024, to file a declaration regarding the 2023 occupancy.

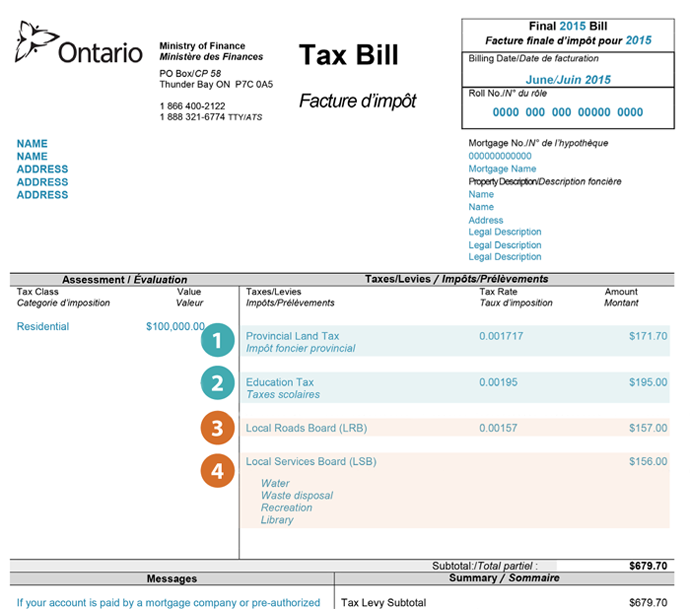

What should i do? These credits are no longer paid as part of the tax refund. Plt = plt rate × assessment.

Toronto vacant home tax. The relative value of all properties in your municipality, compared to your property for the majority of ontarians, your local municipality is responsible for: Rates are set by the province.

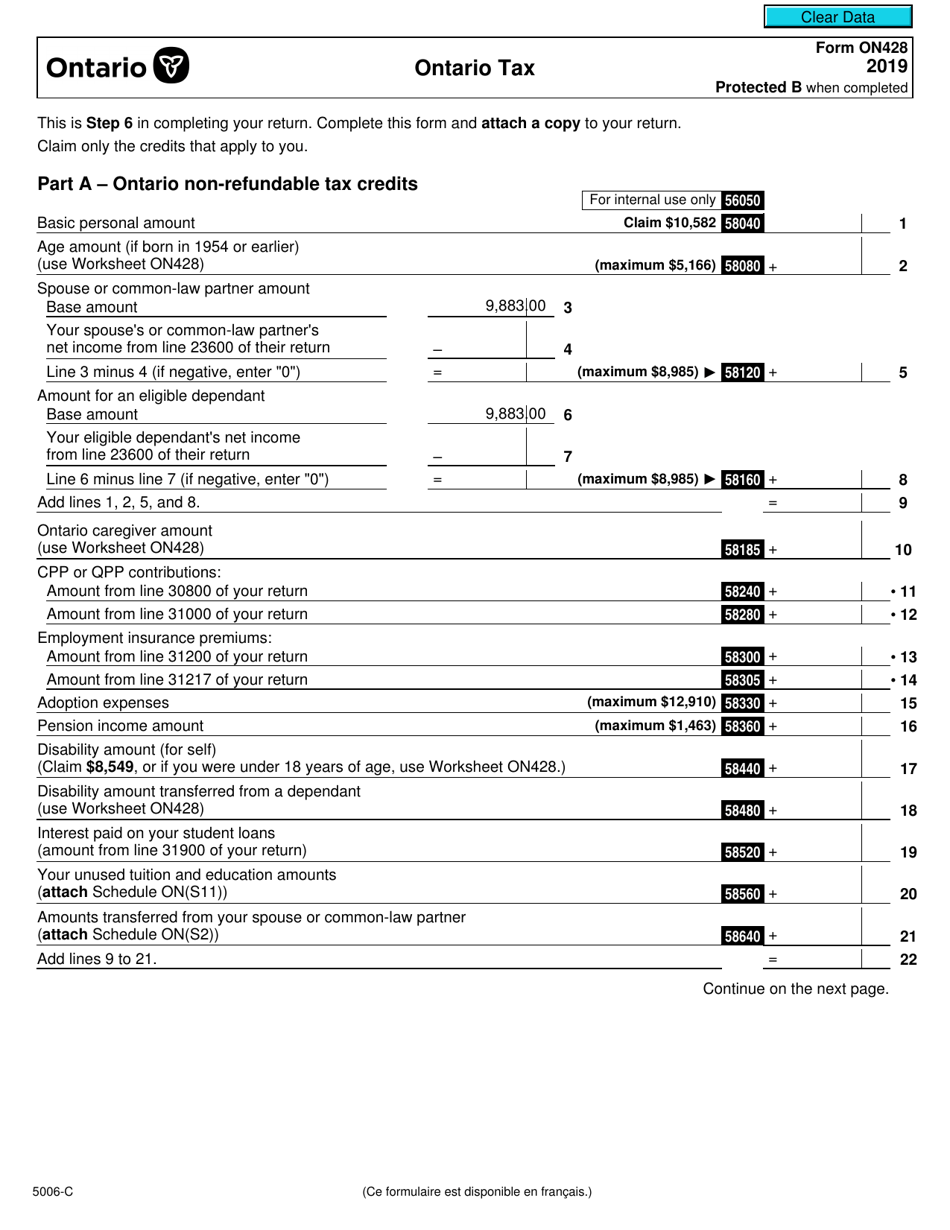

This includes property tax deductions. Can i still apply for the grant? Ontario energy and property tax credit.

Owners of properties in toronto that are classified within the residential property tax class are. Declare the 2023 occupancy status of your residential property. Property taxes are calculated using the current value assessment of a property, as determined by the municipal property assessment corporation (mpac), and multiplying.

Ontario energy and property tax credit. Review all deductions, credits, and expenses you may claim when completing your tax return to reduce your tax owed family, child care, and caregivers deductions and credits. Report the income you've made ensure you've paid the correct amount of income tax

I am eligible for an oshptg payment but i forgot to apply for it when i filed my prior year income tax and benefit returns. Toronto, brampton, oshawa), either for the entire. How much you need to pay will depend on:

Alex wideman | published january 24, 2024, updated january 25, 2024 contents how are property taxes. First, some provinces offer benefits that take into account your. In order to determine how much you can claim, you need to simply divide the total price of property tax by the period of time your home was rented.

You can claim deductions for property taxes associated with your rental property during the period it was eligible for rent. Plt contributes a small portion toward the cost of these services. How to claim the ontario sales tax credit, energy and property tax credits?