Ideal Info About How To Obtain A Tax Clearance Certificate

Login to traces website by entering the “user id, password,tan of the deductor and the verification code”.

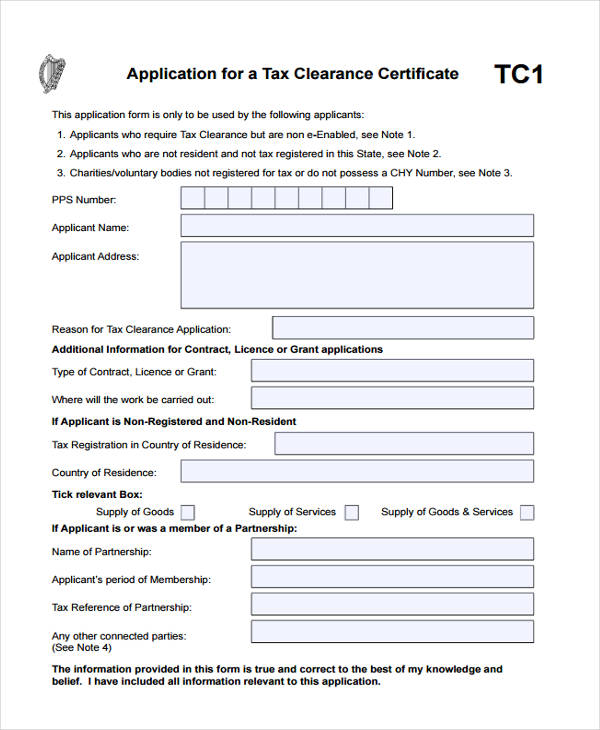

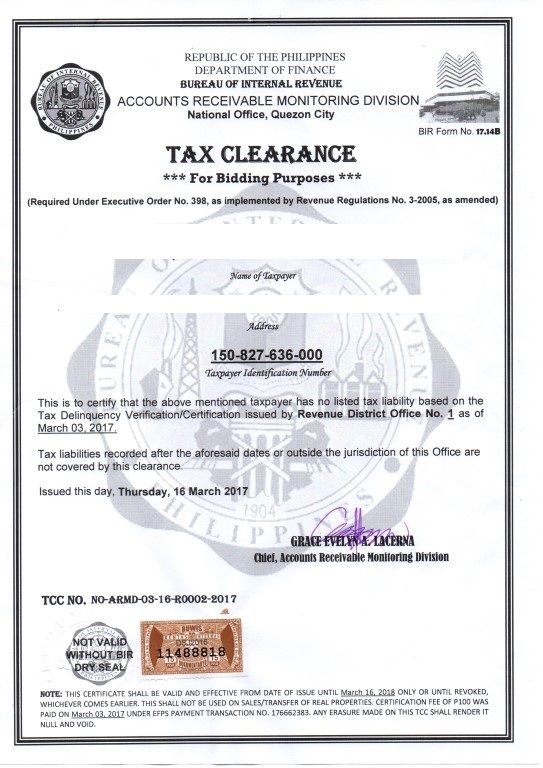

How to obtain a tax clearance certificate. File the final tax return (s). Other parties that are not mentioned (evidenced by appointment letters) taxpayers whose applications are submitted to local tax offices. To apply for itcc, the expatriate has to submit form 30a with all the relevant documents.

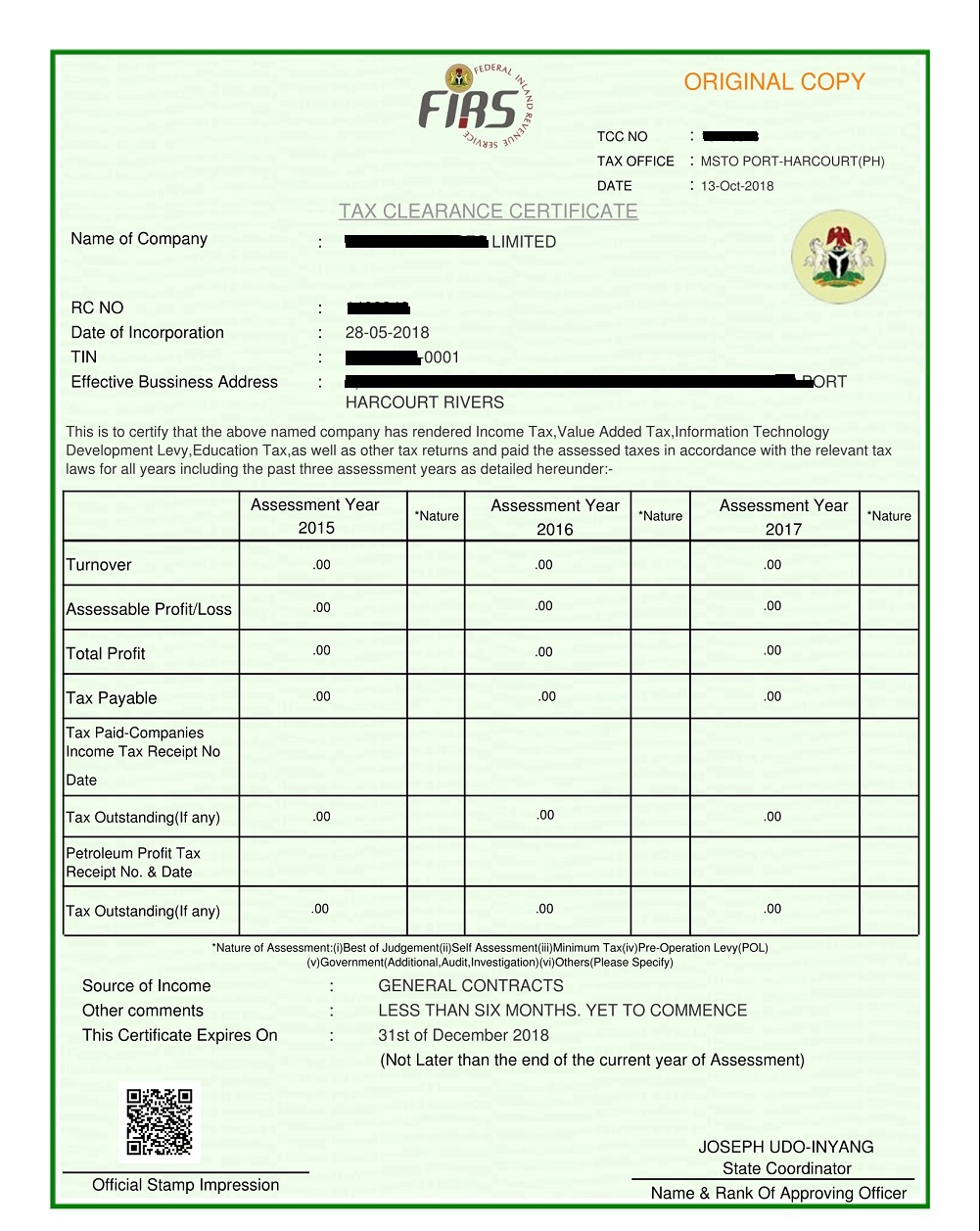

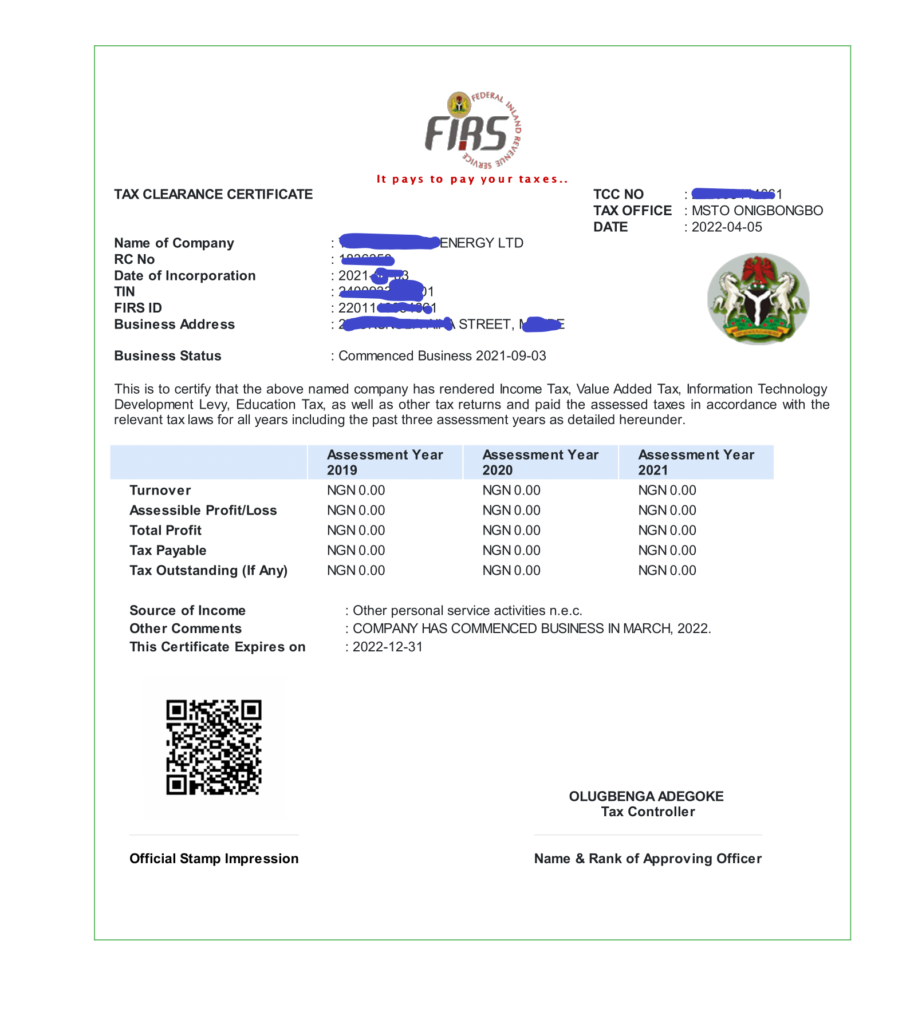

A tax clearance certificate is issued in arrears over a course of three years. Ides stores your public key. The application may also be submitted by the following third parties:

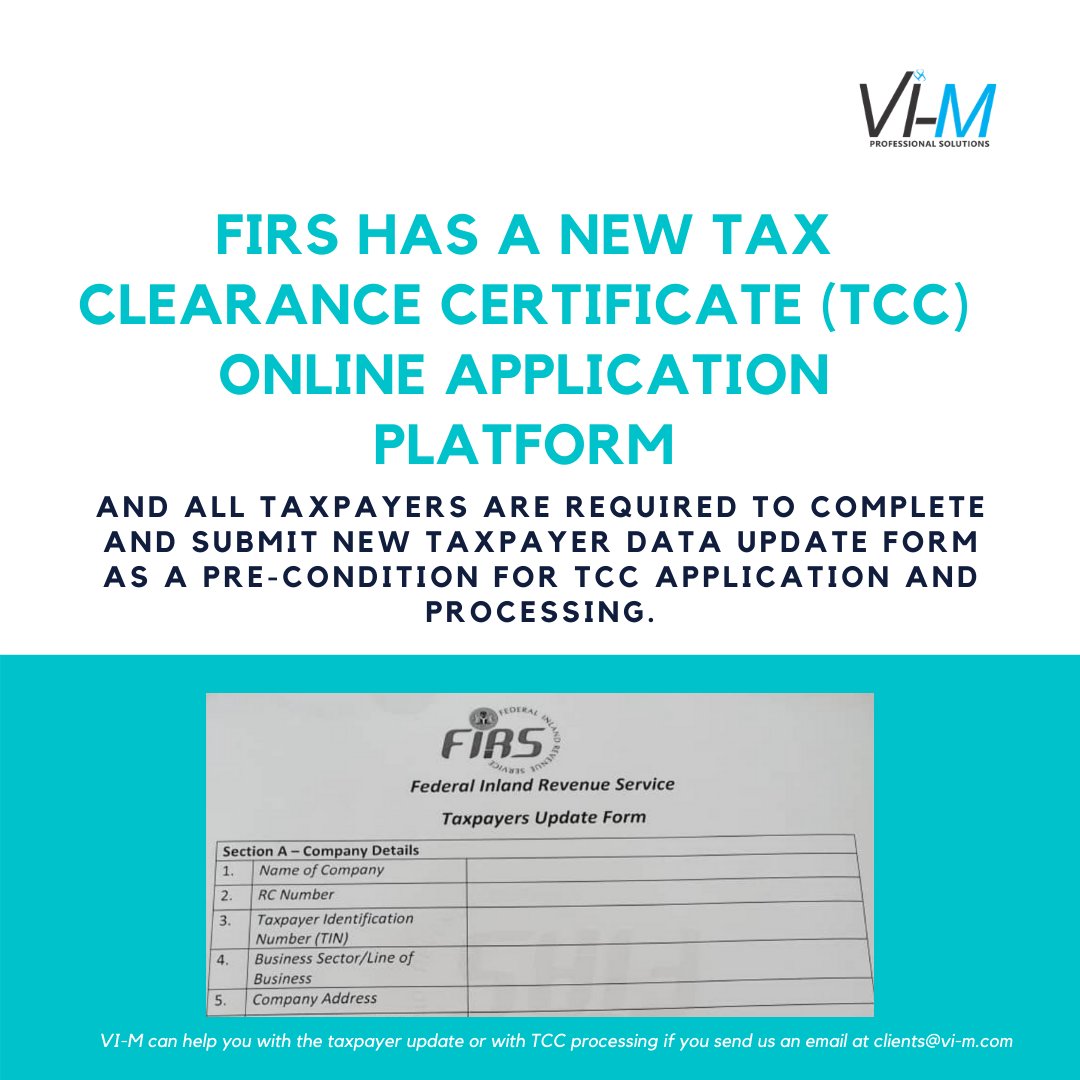

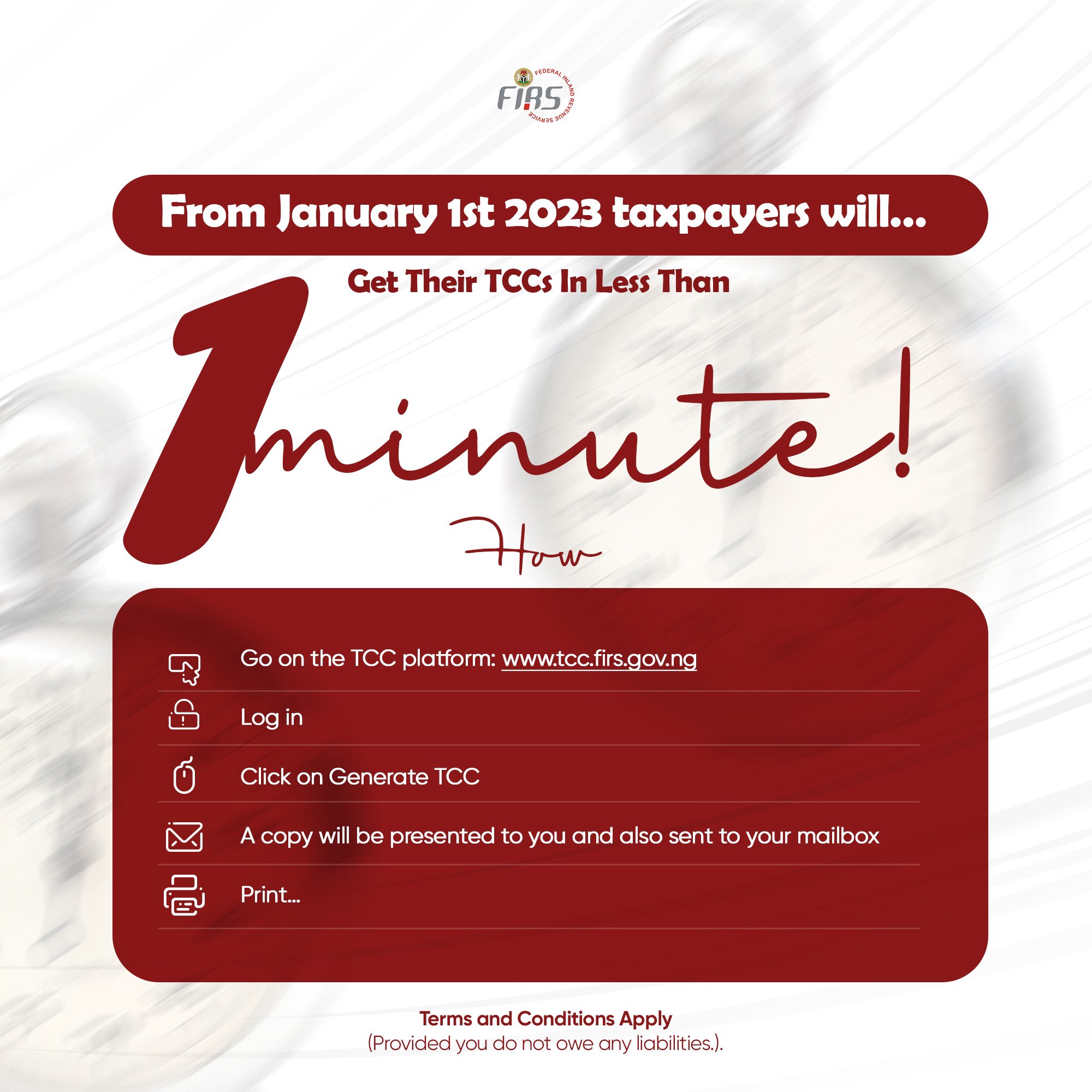

Taxpayers now have the capability to obtain tax clearance certificate in compliance with the. Incorporate your company with the cac (in the case of a corporate body) hire a consultant. On receipt, if the income tax officer is satisfied, he/she will issue the tax.

For help with goods and services tax/harmonized sales tax (gst/hst) or t2 clearance certificates, call 1. Landing page will be displayed. All taxpayers must sign and submit a written application.

The ideal process to obtain a tax clearance certificate is to: Section 85 of the personal income tax act, 2004 (as amended): Individuals can file a proclamation with their employer in india or with the person from whom they receive their.

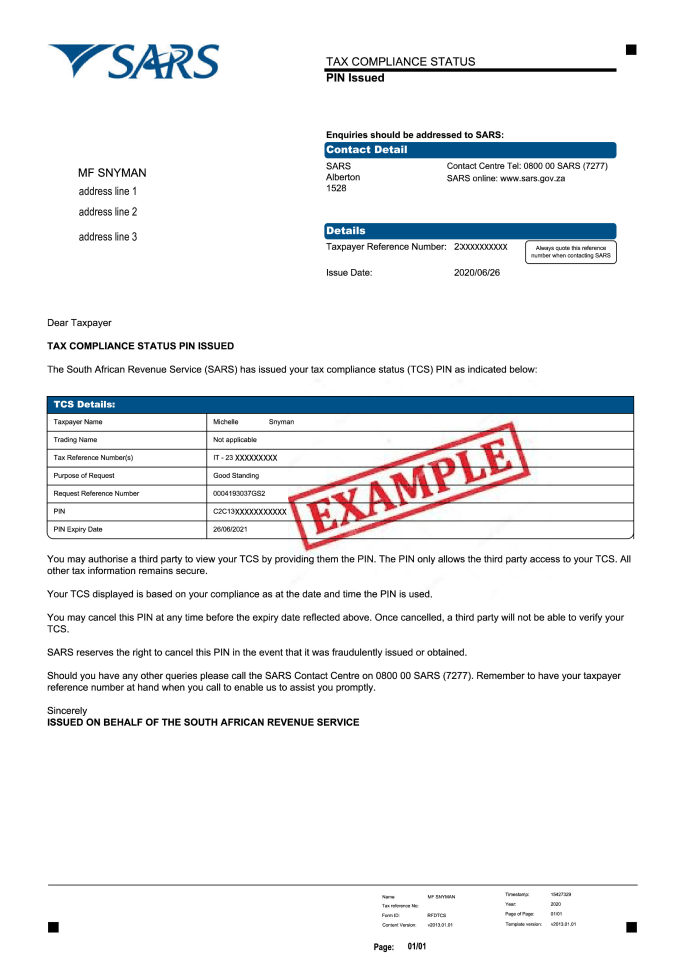

You will then be sent a pin you. A tax clearance certificate is a document given to a foreigner leaving thailand. A tax clearance certificate can be obtained by an individual or a company.

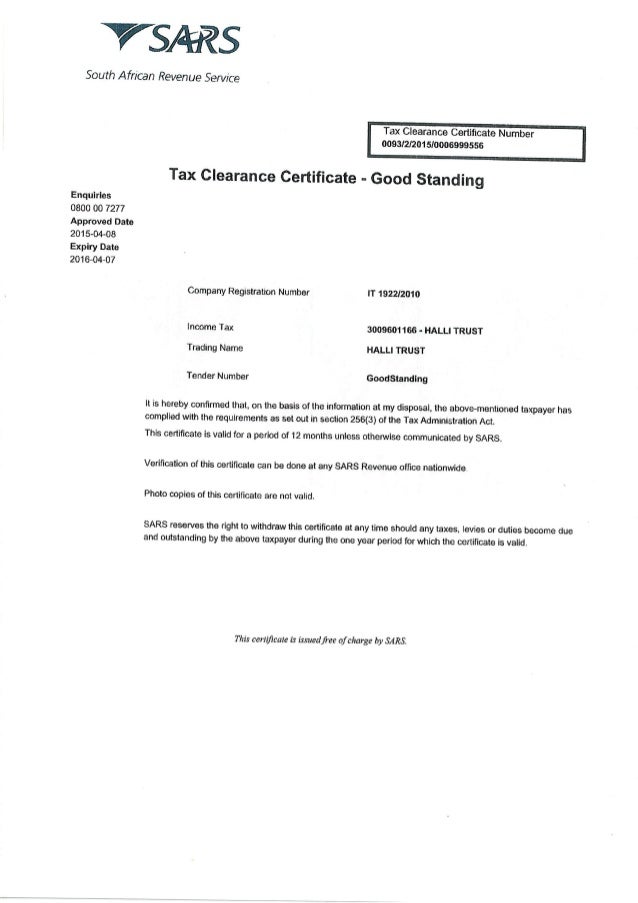

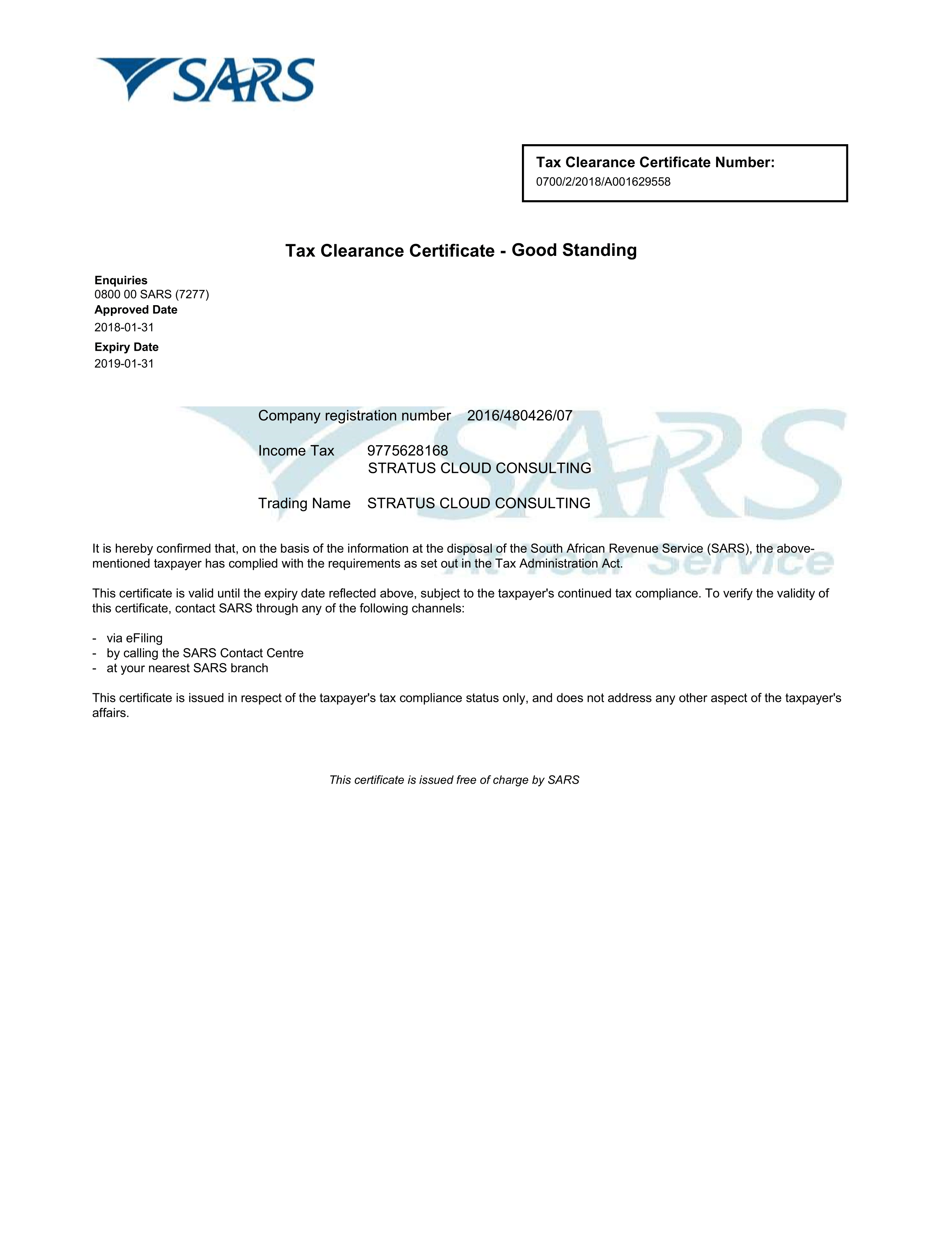

Get the notice (s) of assessment and notice (s) of reassessment that apply. To obtain a tax clearance certificate, you need to have submitted all outstanding tax returns and paid all taxes owed to sars. What is a tax clearance certificate?

How to obtain an income tax clearance certificate? Select the type of tcs you want to generate (the same options as the old tcc). When is a tax clearance certificate required?

What is the tax compliance status system? The application for business assistance tax clearance must be completed, signed by the applicant, and submitted to the division of taxation, at the address listed on the. On the submission page, simply fill in your relevant details and submit the form at the bottom of the page.

Once sars has verified that. Your tax clearance information can be obtained via the tax compliance status system. Leave a reply cancel reply.