Unbelievable Info About How To Buy Distressed Real Estate Debt

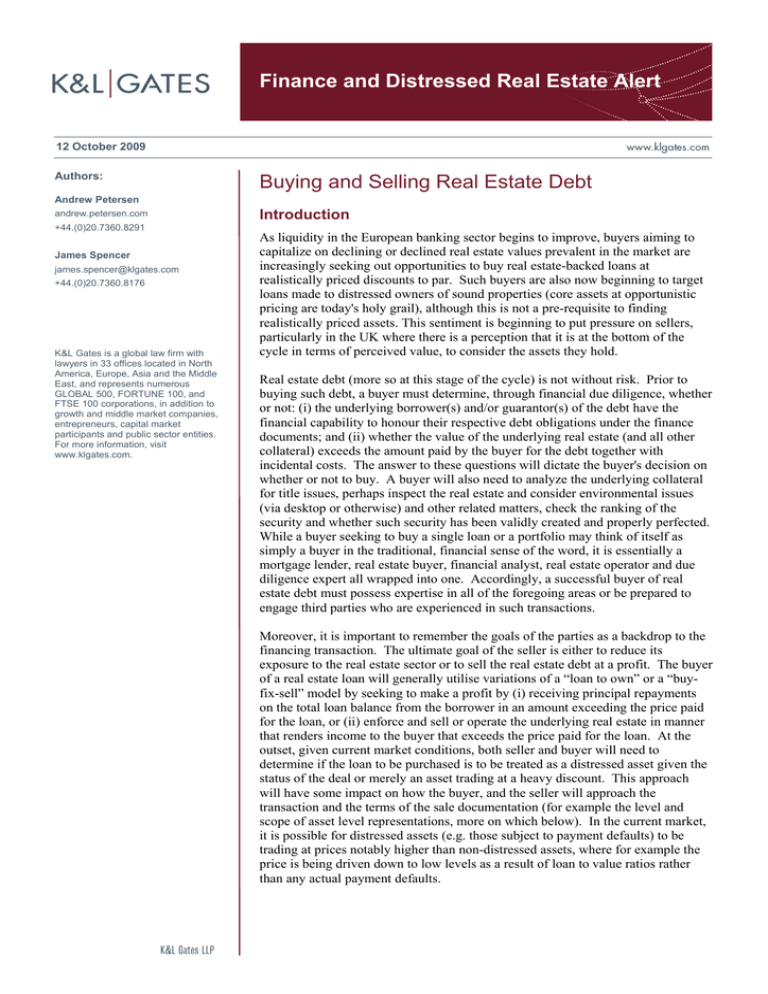

A borrower facing a loan maturity default is more likely to consider a distressed sale of real estate for a variety of reasons, including efforts to avoid insolvency or hold off foreclosure, or when alternative sources of.

How to buy distressed real estate debt. And for a moment in time, these investors appeared to be. If the borrower defaults on the loan, the investor can foreclose on the property and sell it or reposition it. The lender will usually offer a credit bid (or the amount of the outstanding debt) and oftentimes will be the highest bidder at auction.

The physical condition of a distressed property is deteriorating. When to enter the distressed market to ensure. Seyfarth’s 2024 survey examines the industry’s current market sentiment as.

Distressed real estate debt doubles. How to make money from distressed real estate in 2021. Part i “so you want to buy distressed debt.

Traditional ways to acquire a distressed property are: At a foreclosure auction held by the lender, or a bankruptcy auction held by a court. The more technical definition is that distressed real estate is a property that is sold at a discount due to one (or more) of the following reasons:

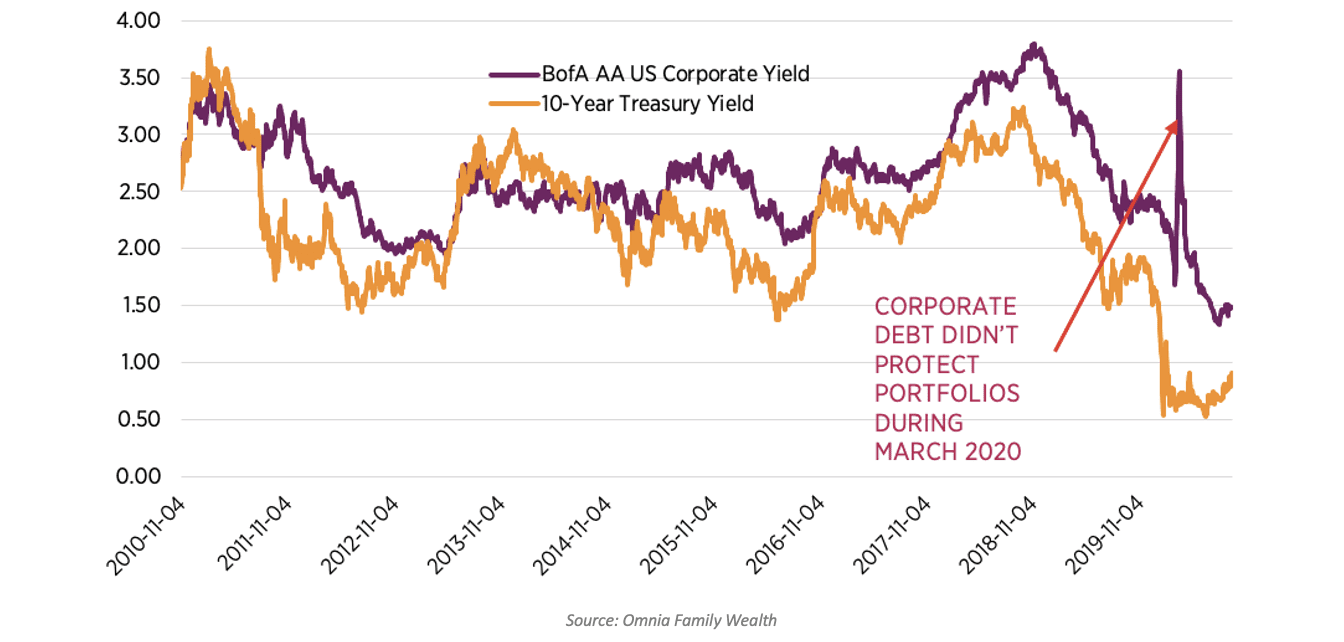

Pension funds and other institutions are considering investing in problem properties via kkr, apollo, blackstone, and other wall street players. The easiest way for a hedge fund to acquire distressed debt is through the bond markets. Distressed properties can be found through online real estate platforms, broker relationships, lender connections, direct mailing campaigns, and networking within real estate investment circles.

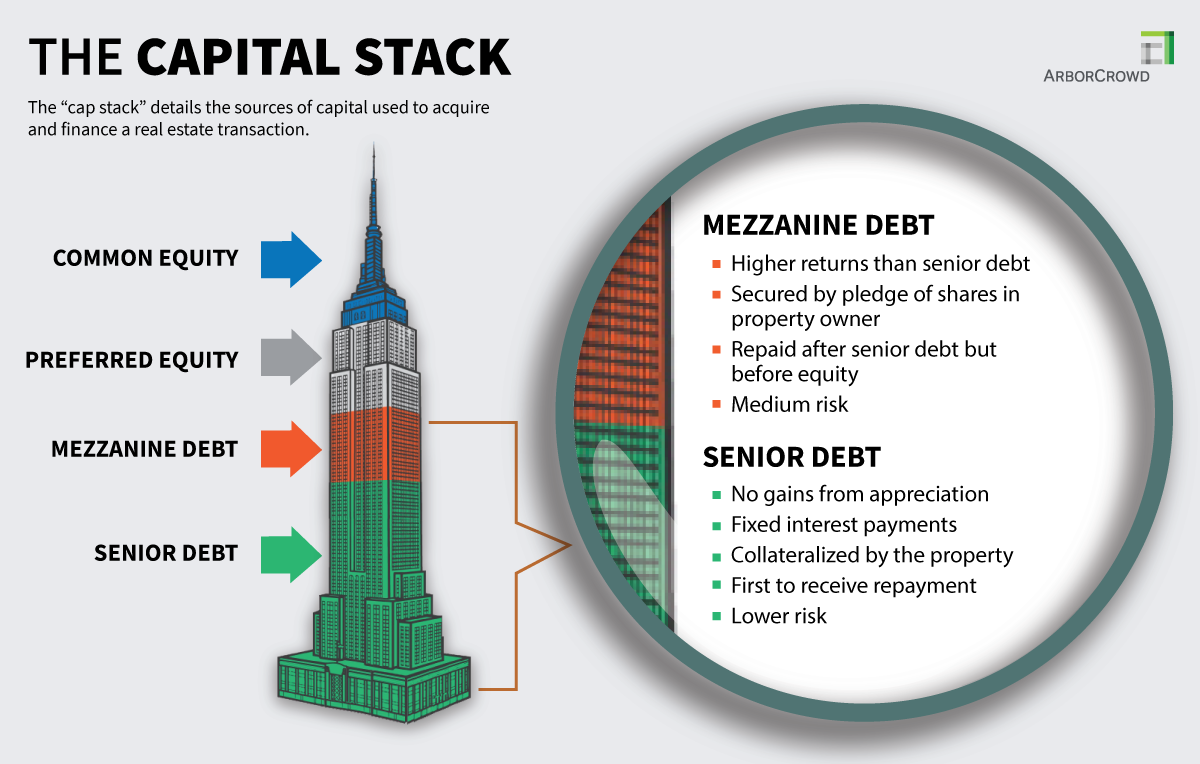

Out, enforcing remedies and liquidating distressed real estate debt, with discussion that is generally applicable to properties located anywhere within the united states, and a focus on the relevant legal frameworks for properties located within the states of california and new york. What are some common exit. Distressed real estate, or distressed debt, is when there’s a dislocation between the asset value and the actual loan exposure anywhere in the capital stack.

Typically, a title company, or in some states an attorney, searches the debts and/or liens affecting real property, and you can search either by address. The first debt category, real estate debt, is the easiest to search. Updated december 21, 2023 when it comes to leaving a home, the process can be stressful enough without dealing with the added headache of figuring out how to sell a distressed property.

Commercial mortgages packaged into collateralized loan. Such debt can be easily purchased due to regulations concerning mutual fund holdings. Goodwin real estate partner chauncey swalwell lays out some considerations for when opportunities to purchase distressed debt are available for potential investors.

About 8.6% of commercial real estate loans bundled into collateralized loan obligation were distressed by one measure in january, a huge surge over the prior year’s proportion after. Amid this market disarray, there remains approximately $2.4 trillion in multifamily and commercial real estate loans scheduled to mature between 2023 and 2027. Michael barr, who oversees bank supervision at the us.

How to source and evaluate distressed deals. Amid the downturn sparked by the. For a creditor to secure a lien on real property, they usually must file a lien in the applicable real property records.