First Class Tips About How To Claim Back Emergency Tax

Faqs learn how to grow your 1st £100k!

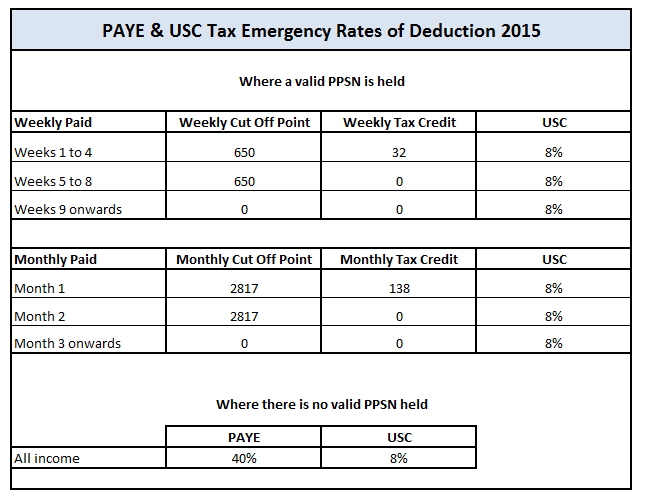

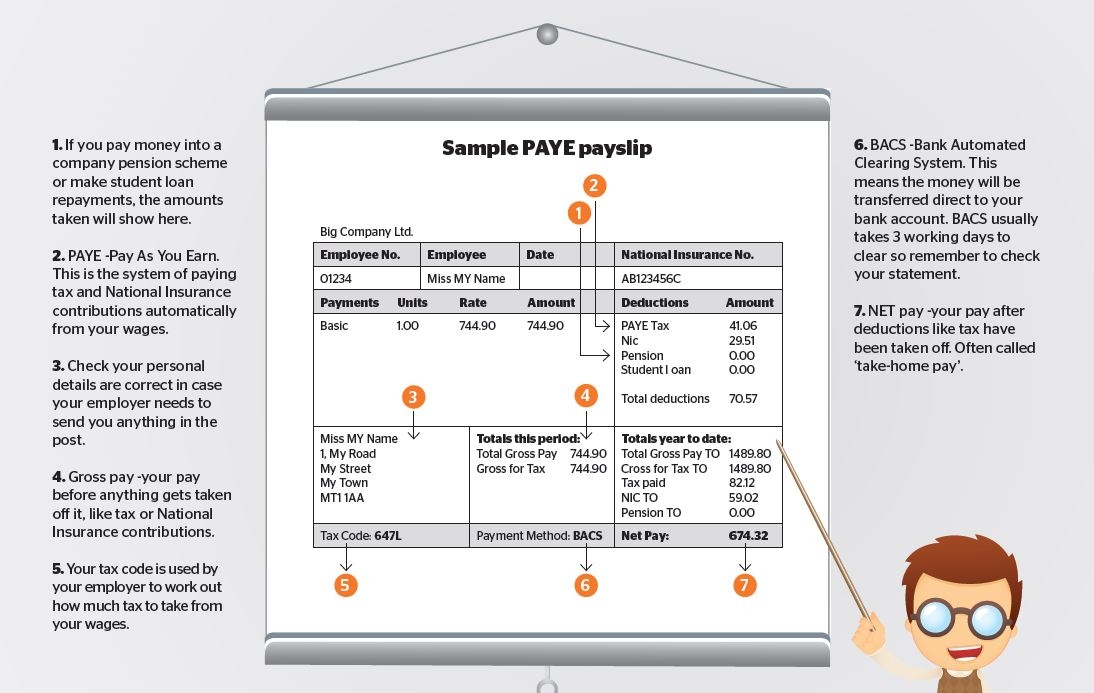

How to claim back emergency tax. Emergency tax is often much higher than what you should be paying, so you may notice as soon as you get your pay that it is less than you were expecting. How can you claim back emergency tax? You may need to claim back the tax you’ve paid if you’ve changed your circumstances and not paid the.

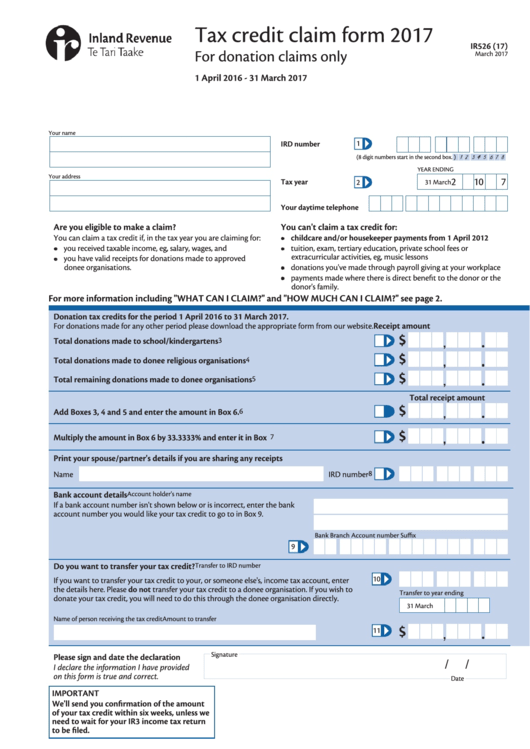

A missionary society. You can also use this form to authorise a representative to get the payment on. You can get back overpayments caused by an emergency tax code in various ways.

In nevada, the lyon county emergency communications center asked locals not to call 911 with an at&t device and, instead, “call from a different service provider.” The most common tax code for tax year 2021 to 2022 is 1257l. This will enable us to review the year and issue any refund due.

Emergency tax how to claim back emergency tax it’s possible for an emergency tax code to leave you paying too much tax. Hmrc requires the correct information.

If you notice you’ve been put on an emergency tax code, it can raise a few concerns or at least some questions. We'll be in touch with the latest information on how president biden and his administration are working for the american people, as well as ways you can get. And this is how that tax is calculated:

You'll be charged tax on the remaining £18,952 (£20,000 minus £1,048 = £18,952). 25 august 2022 at 6:36pm. 27, 2024 — the internal revenue service announced today tax relief for individuals and businesses in parts of california affected by severe storms.

Five medical expenses you can deduct on your taxes. 21st february 2024 although receiving an emergency tax shouldn't be concerning, it is important to know why you have one and to correct it if it is incorrect. Firstly, if your p800 shows you’re.

This tax code will normally be applied if your pension provider hasn’t received a valid. Firstly the 0t tax code is not the emergency tax code that is 1257l. The quickest and easiest way to claim a refund is by using our online service myaccountto complete an income tax return.

The 0t code is used for anyone who declines to give the information required on. After submitting a freedom of information request, royal london discovered that roughly 2,300 pensioners claimed back over £10,000 in emergency tax on their pension income. Use this tool to find out what you need to do if you’ve paid too much tax on different types of income, such as a job, a pension, a self assessment tax return or a redundancy.

For refunds of emergency taxfrom a previous year, you must submit an income tax return for that year. If your tax code ends in ‘w1’, ‘m1’ or ‘x’, you’re on an emergency tax code. The emergency tax code in the 2023/24 tax year is 1257l/m1.

![[SOLVED] HOW TO CLAIM BACK EMERGENCY TAX IRELAND? YouTube](https://i.ytimg.com/vi/NhCXIvhXmE8/maxresdefault.jpg)

/euro-paper-money-667446296-590c9f553df78c928314ea46.jpg)